Previously, we discussed why it is important to review the various real estate investing (REI) strategies and determine which one fits you best in your current situation. If you missed it, here’s the link to that article

We also introduced the proprietary REI Matrix and discussed the wholesaling model, found here as well as the “fix and flip” model, which you can read up on here.

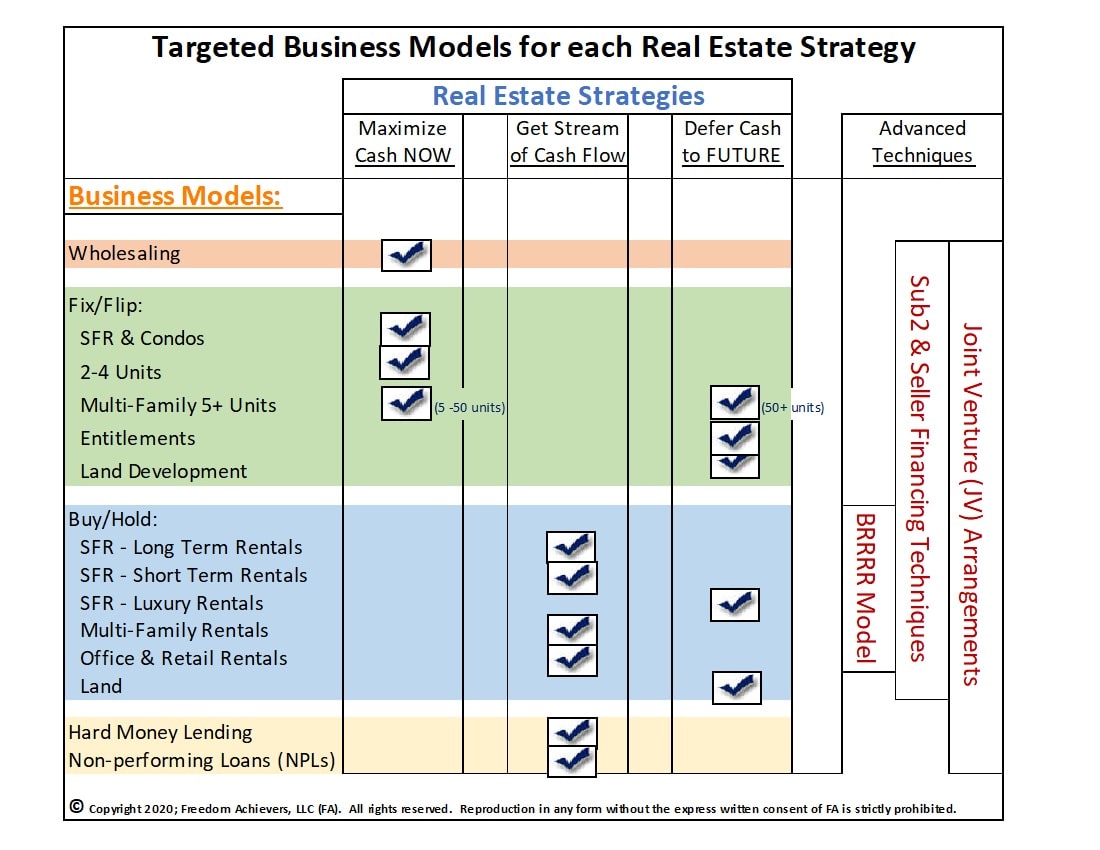

As a refresher, here is the matrix I developed to show the primary investment strategies, as well as the various business models that are most aligned with achieving those strategies:

This week, we take a 40,000-foot view of the “buy and hold” model and its top sub-models. Many of these vehicles are effective at providing cash flow, starting either immediately or within months of placing your investment, while others are focused on appreciation and the opportunity for cash in the future.

Buy & Hold Models

As the saying goes, “Cash is King.” And if you’re looking for cash flow, secured by real estate, most of the vehicles in the “buy and hold” section of the matrix above can help you accomplish your goal. As contrasted by Wholesaling, where you don’t add value to the property itself, and fix and flip, where the whole premise is adding value to the property, the buy and hold model falls somewhere in between.

The buy and hold (rental) strategy is popular among investors of many ages and career paths. For most, the goal is to generate a relatively predictable regular cash flow which can supplement, and possibly ultimately replace, the investor’s current income from a traditional job. We generally visualize residential properties (houses, apartments, condos) when we think of rentals. But commercial properties like offices and shopping centers are also an option here for the more experienced investors, although they can be riskier and financing is considerably more difficult to get than for residential properties.

Here are some indicators of how the buy and hold model compares with the wholesaling, fix and flip, and other models including traditional realty (realtors):

| Indicator | Grade and comments |

| Speed to $ Proceeds: | Low – Medium

The whole premise of this model is to create a stream of cash flow, so while the cash flow might be relatively predictable and regular, this is not a model that is designed to get lots of cash, and particularly your initial investment and appreciation, quickly. It’s more of a slow and steady game. |

| Capital Required | High

Typically requires much more capital than Wholesaling; but often less than fix and flip, especially if your credit is good and you can take advantage of rental loans. |

| Market Risk | Medium – High

Since you will be holding the property for years, there is a greater risk that the market will hit a downturn or two, as opposed to the Wholesaling or Fix/Flip models. If you are not highly leveraged on the property, however, you can mitigate this risk if you can keep the property rented during the downturns, allowing you to weather the storms. |

| Time Intensiveness | Medium

This model is less time-intensive than the fix and flip model, as least on average. However, if you are purchasing distressed properties and fixing them up prior to renting them, then it can become just as intensive, at least for this part of your ownership cycle. Once the property is rented and stabilized, however, it should require much less time to manage than a fix and flip property. |

| Reward Potential | High – Very High

When both the cash flow and appreciation components of these investments are considered, this model can have as much potential for profits as any other. Despite the higher requirements of capital market risk, the profit potential is enticing. And don’t forget about the cash flow along the way, which is likely the primary reason that you are investing in these vehicles. |

| Typical Annualized ROI | Medium

When executed without debt (all cash), this model can provide fairly high annualized returns (around 5% – 15%). When debt (leverage) is utilized, the debt service payments can drop the profits but the assets can still provide good cash on cash returns. Below, we will introduce a concept of how combining debt leverage with this model can help you build a winning portfolio in a faster amount of time than you probably thought was possible. |

Within the overall Buy and Hold model, many find that using residential real estate (one to four units) is an excellent way to obtain both cash flow and equity, with the ability to tap into the appreciation by either refinancing the property or selling it in the future. Properties with 1 – 4 residential units can be financed with conventional residential financing, which is readily obtainable. In this model, your focus may be cash flow, but you will likely also realize appreciation gains as well, during your hold period. Your best purchase discounts can be obtained by buying distressed properties, but be cautioned that if the property is too distressed (kitchens or flooring are incomplete, etc.), you may not be able to get conventional financing on the property until repairs are made. That doesn’t mean that you shouldn’t target these properties — as they can be some of the best deals because you can get extra deep discounts on them — but be prepared to purchase such properties with a combination of cash and hard money; with the plan of refinancing into lower cost and longer-term financing once the improvements are made.

Maybe this all sounds good to you, but how do you build a portfolio of 10 properties if you have the cash to invest in one? Let’s briefly explore a representative scenario…

BRRRR?! Is it cold in here?

Let’s say you have $100,000 of cash to invest and kick-start your cash flow portfolio. The typical buy and hold deal in your local market sells for $100,000, but needs $10,000 of improvements, and the carrying costs (property taxes, utilities, insurance) needed until the units are rented out is another $5,000. Once the property is improved and rented, the appraised value will be around $150,000. So it will cost you $115,000, but it will be worth $150,000 if/when you can execute the deal. But you only have $100,000…

So to get the deal, you get a private/hard money loan at 80% of your purchase price, or $80,000. That leaves you with $20,000 to cover the $10,000 of improvements and $5,000 of carrying costs, with $5,000 leftover to service the debt on your new loan and for cushion/reserve.

After the property has been improved and tenanted, you can then refinance it with conventional financing, typically at 70% – 75% of the appraised value of $150,000. 70% of $150,000 is $105,000, and even after loan & escrow costs (say $5,000) to close on the refinancing transaction, you will have your $100,000 initial investment back, plus $45,000 in equity ($150,000 value minus $105,000 loan), plus the cash flow stream that it will generate!

You take your $100,000 and start the process again, by finding another deal and doing the same steps. We call this the BRRRR method (Buy, Rehab, Rent, Refinance, Repeat) and it’s a great way to use your same funds, over and over, to build a portfolio of cash flow properties (with equity as well!).

Buy/Hold Tax Tip

Here’s some more food for thought. When your property appreciates by perhaps 20 – 25% over a 5 – 10 year period, it might be tempting to sell it, take the proceeds, and reinvest in another rental property. But the “extreme” buy and hold investor never sells the property – however, he/she might do a cash-out refinancing every 5 – 10 years to pull out tax-free loan proceeds and invest those proceeds into a new Rental property, while still keeping the other one and avoiding the taxable event of selling the other one. Check with your tax professional to see your options.

Buy/Hold Investing doesn’t always mean Passive Investing

Just because being a landlord is generally considered a passive investment model, that doesn’t mean that it doesn’t occasionally include actively renovating the property. Depending on the condition of the asset you are purchasing, you may not have to do any physical improvements to the property, or you may need to incorporate many of the resources & skill sets that fix and flippers do, only with a different exit strategy in mind. To clarify, some buy and hold investors buy distressed properties and improve them significantly, just like fix and flip buyers. But the difference is that while fix and flippers will usually then retail the properties on MLS, the buy and hold investor will secure tenants and start depositing monthly rent checks.

The Financing Choice becomes more Important for Buy/Hold Investors

Unless you are sitting on a mountain of cash, you likely realize that financing can be very important to any real estate investing model. When it comes to the buy and hold model, however, it becomes particularly important, because the investor plans to hold and cash flow the asset for years, if not decades. You’ll want a longer-term loan (5 – 30 years) with low-interest rates, in order to provide the stability and cash flow. A swing of 1% in the interest rate can often make the difference between a good, cash-flowing asset, and one that is just mediocre. This contrasts with the fix and flip model, where a 1% swing in interest rate is usually negligible since the project is normally completed and sold within months.

On a $200,000 loan, a 1% interest fluctuation correlates to $167/month, which can be easily overcome on a fix and flip that might only last 6 months ($1,000). But on a rental property, when you may only have a $250 per month cash flow to begin with, that same $167 per month takes away two-thirds of the cash flow. And over a 5 year period, it could result in ~$10,000 less money in your pocket.

Let’s take a quick look at the buy and hold vehicles that are listed in the matrix at the beginning of this section:

SFR Long-Term Rentals

Most Buy/Hold investors get started by renting out SFRs (Single Family Residences) to tenants on 6 – 24-month leases. There are an abundance of SFRs – which can be houses, condos, or townhomes – in most metropolitan areas as well as tenants looking to rent them. Under this long-term rental model, the tenant normally signs a lease (which usually converts automatically into a month-to-month lease if the lease runs out and neither party forces a change or a new lease), moves their furniture in, and puts the utilities in his/her name. The landlord-tenant relationship is governed by the pertaining local and/or state laws.

SFR Short-Term Rentals

Think Hotel meets Residential Home. In this vehicle, the house may be sitting right next to the SFR that we refer to above, but in this case, the house is fully furnished and supplied with entertainment options, utensils, paper towels, etc. Just bring your clothes and personal toiletries. Here, rather than a landlord-tenancy arrangement, the temporary residence is a guest, typically for 1 – 30 days. They aren’t moving furniture in, as it’s already furnished, and the utilities stay in the owner’s name. Since the guest just shows up and has many or all of the conveniences already in the home for them, the rates for these rentals, on a per night basis, are generally many times higher than that of long-term rentals.

SFR LuxuryRentals

Rentals of high-end properties could be considered subsets of the long-term and short-term vehicles above, but it is rare for long-term luxury rentals to provide cash flow returns that rival that of non-luxury properties. As the value of the dwelling increases, the rents rarely increase proportionally. Therefore, it is usually more lucrative to buy and rent 2 – 4 modest homes in blue-collar neighborhoods, than to use the same investment to buy and rent out 1 home in an upper-middle or upper-class neighborhood. That doesn’t mean that it’s a bad investment, but rather, it may not be the type of buy and hold investment that you want, especially if you are counting on cash flow. However, if cash on cash return during the rental period isn’t as important to you as long term appreciation and asset protection, then this might be a winning vehicle for you. That’s because upper-middle-class neighborhoods often weather housing downturns better, by holding their values stronger than lower-class areas. That is why, on the Strategy/Model matrix, I don’t show luxury rentals as cash flow vehicles, but rather as vehicles to defer cash to the future.

Multi-Family Rentals

Multi-Family (5+ units) are very popular investment vehicles for higher wealth individuals, hedge funds, and investing groups. They require more cash to purchase than 2 – 4 unit properties, partly because a 20-unit apartment complex usually costs more than a 3-unit one, and partly because 5+ units make the property a commercial one, as far as financing goes. And commercial lenders usually require a significantly larger down payment (30 – 40%) as opposed to residential lenders (20% or less). Properties with a larger number of units require more management, as well. While you might be able to self-manage your first tri-plex, most owners of 100+ units don’t manage them themselves, but instead hire a professional property management company.

Office and Retail Rentals

Similar to the Multi-Family vehicle above, these properties will also be considered as commercial properties when it comes to financing. But unlike the above vehicles, now your tenants are most likely companies, rather than individuals or families. The lease forms and terms will change, and while many commercial landlords find the leasing process to be more complicated at first, the general consensus is that commercial tenants are easier to manage than residential tenants. For example, I own a small commercial building in my self-directed IRA, which I renovated and made available to rent a few years ago. Both tenants I’ve had have been small companies, on NNN (triple net) leases, meaning they pay for all expenses related to the property, including utilities, property taxes, and my insurance policy on the property. And their checks come regularly while the midnight calls about leaky sinks or clogged up toilets don’t come at all.

Land

The last vehicle within the Buy/Hold category is Land, sometimes referred to as Raw Land, meaning that it either doesn’t have any structures on it, or the structures are essentially worthless and don’t add value to the property. These properties are generally looked at for their land value only. While there are exceptions (such as leasing land to a farmer), usually vacant land is not a cash-flow vehicle, but rather a strategic play for the future. For instance, 40 acres in the middle of nowhere would likely be a speculative investment that may pan out decades from now but isn’t likely to produce cash flow or income in the short run. On the other hand, purchasing a vacant infill lot in the middle of town has many more viable exit strategies. Perhaps you can lease it out for storage. Maybe you can put a billboard or a cellular tower on it. You could wholesale it to a builder. Or re-zone it for its highest and best use. And then sell it or develop it yourself. You get the idea…

Final Thoughts on the Buy and Hold Model

Before you invest in a certain geographic market, do some research to analyze the following three key subject areas:

- Does your target market have a shortage, or a glut, of rental properties? Are rents rising, flat, or decreasing in this area?

- Does your target market typically have less, similar, or greater appreciation than other similarly priced markets that you could invest in? Should you invest in a neighboring community instead?

- Will your financing ability, when coupled with market rents on a typical property, generate a solid cash flow for you?

The desired result from the above exercise is to get you to think about, and then document, the deal and the expected cash flow prior to your purchase. Use a pen and paper, or use a spreadsheet, but do yourself a big favor and prepare this basic monthly financial model:

Expected Rents

-Debt Service (principal & interest payments, if applicable)

-Property Taxes (if shown annually, divide by 12)

-Insurance (convert to monthly cost)

-Homeowners Association cost, if any

-Utilities that aren’t being passed on to tenants

-Pool/landscaping maintenance

-Repairs allowance

= Estimated Monthly Cash Flow

Prices are low enough in many towns/cities where even the typical single-family residence, once rented, can offer nice cash flows, even when leveraged with good conventional financing. For instance, with 80% Loan-to-Value (LTV) conventional financing in place, many of these properties will yield a net positive monthly cash flow of $250 or more. If you were to purchase and finance four such properties, that could mean $1000/month of supplemental cash flow. In addition, you get the tax deductions such as depreciation, plus you have 20% equity in these properties, which is very likely to further increase in value in the coming years.