Previously, we discussed why it’s important to review the various investing strategies and determine which one fits you best in your current situation. If you missed it, here’s the link to that article: Click Here

Begin by Choosing 1 of the 3 Primary Strategies

- Maximize the Cash you can get NOW

- Get a STREAM of Cash Flow

- Defer Cash to the FUTURE

What do you see in the words I have capitalized and shown in BOLD letters above?

It’s all about timing. Get the most cash you can NOW, get a Stream of cash (OVER TIME), or wait to get the cash in the FUTURE.

The most important consideration for finding the best investment path for you starts with the introspection and determination of which strategy, or “timing of cash” fits you best at this time. Once you make this assessment and lock in on your overall strategy, you can then choose from the actual models or activities within Real Estate Investing (REI) that will directly help you get where you want/need to go.

Many real estate ‘gurus’ want to steer you towards one particular real estate model or another, usually because that’s the model they are poised to monetize if you can be swayed to follow that model.

They may want to show you how you can become rich overnight by investing in their wholesaling course, or how glamorous it will be if you just take their fix and flip course so you can become like your favorite HGTV couple. There is nothing fundamentally wrong with either of these approaches, as long as that model is the right one for you at this time.

I prefer to take a different approach when mentoring or coaching aspiring real estate investors. Let’s face it, there are lots of ways to make money and achieve freedom via real estate.

But not all ways are suited for all people.

We each have individual strengths and weaknesses, likes, and dislikes. More importantly, we are all in different stages of life, with different needs and resources. While one investor may need income this month to be able to pay the rent, another may be looking to invest money today for a winning portfolio when they retire in 20 years.

What are the Best Business Models for Each Real Estate Strategy?

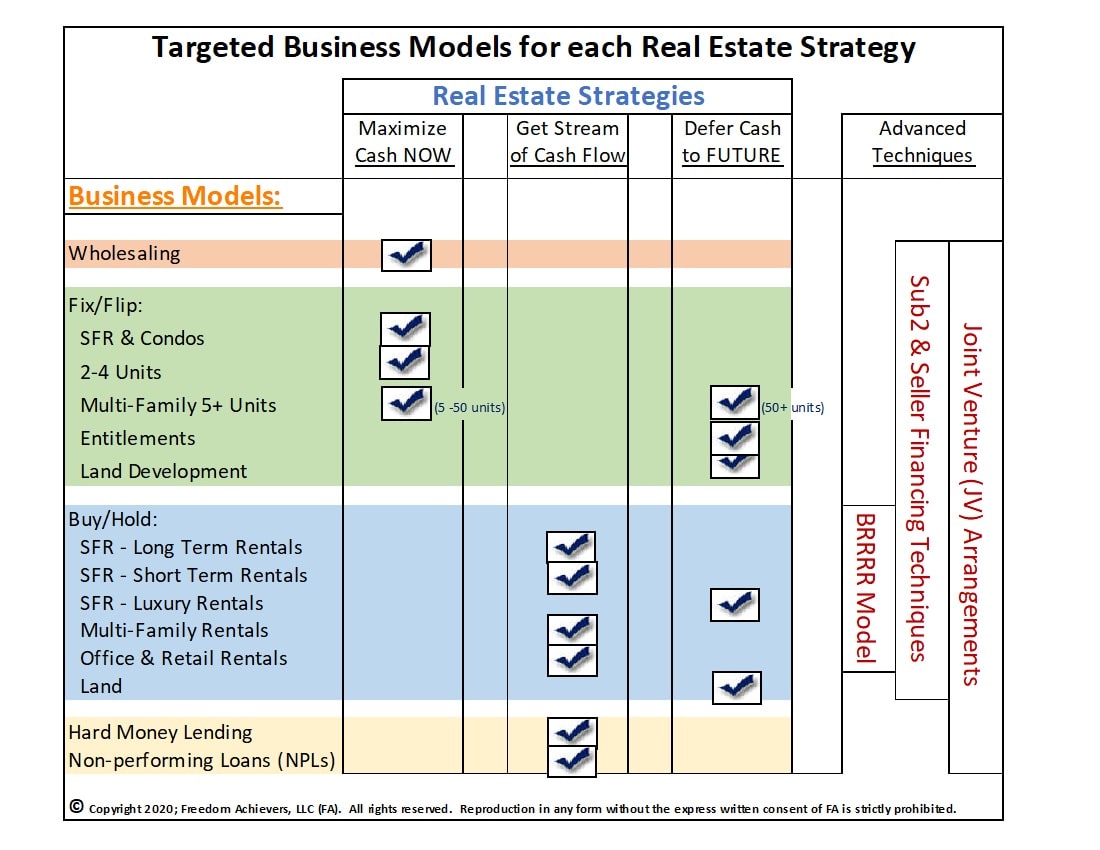

Once you have chosen the right overall strategy for you, it is time to drill down and look at the best ways to start achieving those strategic objectives. The chart below lists most of the various business models that real estate investors engage in. Each one of these business models can be lucrative in and of itself.

In fact, as I am writing this, I am currently actively invested in every single one of these models. My companies and I have made money using each of these, so I can attest to how each can generate cash and support the underlying real estate strategies.

For investors starting out, however, I strongly advise that you select just one or two of the below models to master first, before possibly adding others to your repertoire.

Using the chart below, identify which major strategy is right for you at this time. Choose that column — Maximize Cash Now, Get Stream of Cash Flow, or Defer Cash to Future — and follow the column down vertically to identify the key models that can help you achieve your chosen strategy.

The REI Matrix – Where Strategy Meets Business Models:

For instance, if your overall strategy is to Maximize/Get Cash NOW, then likely the best vehicles or models to achieve that would be either a) Wholesaling or b) Fix/Flip of Single Family Residences (SFR’s), Condos, or Multi-Family properties up to about 50 units.

Does that mean that if Sarah is a beginner in the REI world and needs to get some cash to pay her rent this month, that I’m advising her to jump in and fix/flip a 30 unit apartment building? No way! If she doesn’t have her rent money in hand for this month, how is she going to have access to the millions of dollars of capital needed to purchase, rehab, and re-tenant the property?

Plus, such a project would take months or perhaps years to renovate all the units, so this particular model isn’t right for her yet, even though it’s marked with a checkmark on the column under her key strategy.

While a seasoned multi-family investor may have the cash reserves, crews, and processes to rapidly rehab and retenant this project within 4-6 months, it’s not a good one for Sarah to cut her teeth on, for many reasons.

Similarly, if Isaiah is an introverted newbie in REI and needs $10,000 by next month to pay for his grandmother’s upcoming operation, am I telling him to ‘use mind over matter’ and overcome his introversion by knocking on 100 doors a day? And to keep knocking on those doors until he finds a prospective seller where he can get and assign his purchase contract for the $10k wholesale deal he needs? Absolutely not!

His personality has developed over the course of his lifetime, and by trying to force him to change his nature overnight, I would likely be setting him up for failure, he would probably end up hating his new-found real estate model, and be left with less money than he had before. There are other ways to participate in the Wholesaling model besides forcing him to do what isn’t his strength.

Matching Models and Resources for Success

Rather than forcing a square peg into a round hole, wouldn’t it be wiser to first take inventory of what your strengths, weaknesses, and resources are? Here is a partial list of questions that you should answer for yourself before you forge ahead and ‘invest yourself’ into one of the models in the above chart:

- What cash do I have access to in order to get started?

- Can I leverage my FICO (credit) score to borrow some seed capital?

- What skills or expertise do I already have that I can parlay into my real estate career? For instance, am I a skilled handyman? Or a proven salesperson? Or maybe excellent at analyzing financial models?

- How strong is my network of friends, family, and acquaintances, and can they help me with the above areas?

- What areas do I know I’m either weak in, or despise doing, and how can I leverage tools or people to fulfill those areas? Do I love dealing with people, but hate paperwork, contracts, and spreadsheets?

- If I don’t have the skills and or resources to handle 100% of the business model(s) that I need, can I locate and work with a mentor, coach, or joint venture (JV) partner that has already mastered those areas?

Each one of the above questions can be greatly elaborated on, but for now, you get the idea; think before you act and as I like to say, “put yourself in position to succeed”.

We will now start to take a deeper dive into the individual business models, starting with wholesaling.

Wholesaling

Wholesaling is the most popular business model for investors who are newer to real estate. Here are some indicators of how this broad model stacks up, as compared with fix/flip, buy/hold, and even traditional realty (realtor) models:

| Indicator | Grade and comments |

| Speed to $ Proceeds: | A+ Can often convert a lead into Cash within weeks |

| Capital Required | A Much less Capital needed vs. typical Fix/Flip or Buy/Hold |

| Market Risk | A Market Risk is Low as deals typically progress quickly from contract to closing, mitigating risk |

| Time Intensiveness | B+ Can be done part-time and oftentimes you can make your own hours, as opposed to a model like Fix/Flip, which requires lots of management |

| Reward Potential | B The profit potential is typically $5-15k per deal, depending on the area & competition; and the risk of taking a loss on a Wholesaling deal is typically lower than on Fix/Flip or Buy/Hold |

| Typical Annualized ROI | A When executing well, wholesalers can often double their invested funds, resulting in annual returns on investment of well over 100% in many cases. |

Here are several additional features of the wholesaling model:

- You are dealing with professional investors, at least on the disposition side of the transaction. Most end buyers of your wholesale properties will be fix/flip and buy/hold investors, sometimes with realtors helping them. It is often easier to work with professionals than it is to work directly with homeowners who may be emotionally tied to or unrealistic about their properties.

- You can build relationships with these professionals, which will lead to repeat business. We have buyers who have done many deals with us throughout the years. It’s always easier to do business with someone who already knows you, likes you, and has received value (a discounted property) from you in the past than it is to nurture a brand new relationship.

- There is often less competition for a typical wholesale-type property than there is for a retail property. That’s because wholesale properties typically involve either a distressed property (a fire damaged house won’t qualify for conventional bank financing) or a distressed situation (the seller gets job transfer across the country and needs to sell the house in 2 weeks and needs a cash offer with a quick close).

- You can have a much quicker turnover of the properties since a wholesale investor/buyer will use cash or hard money to purchase the property, so the sale can be closed within days — as opposed to waiting months longer to find a retail buyer through the MLS and hoping the formal home inspection process goes well, their appraisal comes in at value, and their financing goes through about 45 days later.

Remember, the business model of the wholesale investor/buyer (your customer) is generally to buy the property from you at a below-market price, and then either a) fully renovate the property and then sell it in the retail marketplace, or b) repair it to rental grade and lease it to a tenant.

Your value as a wholesaler is to provide these buyers with a steady stream of inventory, for which they will reward you with repeat business of fast closing transactions, which aligns with your “cash now” strategy.